Bottom line:

you want to get paid

quicker.

We help you enhance your profitability, get paid faster and secure your cash flow through smart credit management.

CREDIT MANAGEMENT

Our core

solution

It doesn’t matter what kind of company you are - getting paid quicker or getting paid at all is crucial. Better cash flow increases your margin and decreases your dependency on foreign capital, and good liquidity minimises the need for credit. A careful handling of accounts receivable not only leads to faster payments, but it reduces the risk of blows to your balance sheet. Smart credit management optimises your working capital. That’s the bottom line.

Mitigate your credit risks

Strengthen your relationships

Get your bills paid quicker

More

solutions

Our credit management solutions handle most of the day-to-day work for you, freeing-up time for personal communication with your customers when needed. This leads to increased customer satisfaction, and happy customers means customers who continue to pay.

PolicyManager

CaseControl

What our customers say about us

We value our customers highly, here's how they value us.

Managing

data

Different departments gather different data. Manage risks effectively and ensure seamless information sharing across divisions by collecting all your data in one place.

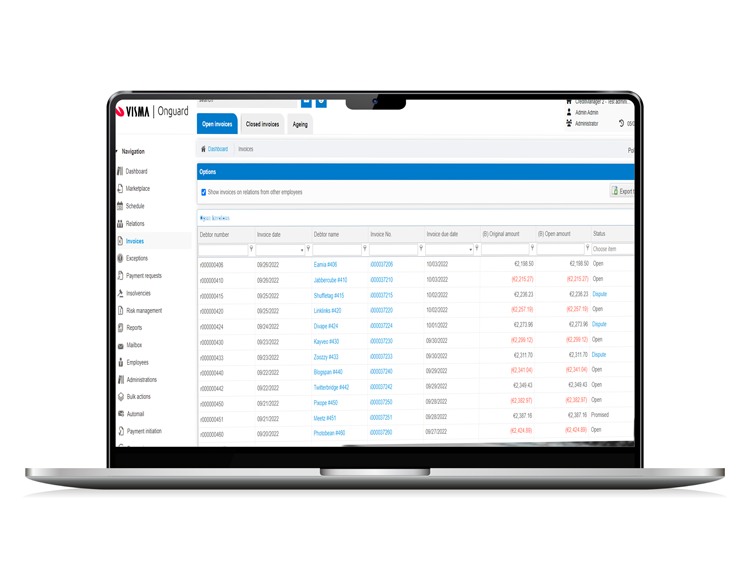

Birds eye view

of Onguard

We combine all our insights to create the best experience for our customers. With our proven track record, we know we can help you get paid quicker, reduce your risks and grow your business.

Our customers

Join other leading brands in optimising your credit management processes.

Blogs, whitepapers, podcasts and more

Get inspired

Check out our media section on credit management for expert insights and actionable tips to optimise your working capital and improve your cash flow.

Working at Onguard: Meet Natascha

She has been working at Onguard for 24 years, she loves philosophy and art, and she is Onguard’s go-to person for sustainability, a former active member of the work council, the organisation’s Unicef project team member, and a gender diversity advocate. Meet Natascha Umans, Senior Account Manager at Onguard!

A look back at 2024: 5 trends in credit management from the past year

The trends of today are shaping the trends of tomorrow. How has 2024 unfolded and what is expected for 2025? As this year has come to an end, we gathered a list of the top themes that caught our attention through the past year.

AI to influence 50% of strategic decision-making in finance by 2029

While fewer than 20% of strategic decisions currently leverage AI in the Dutch finance sector, this figure is projected to surge to nearly 50% within the next five years. This is according to the latest Deloitte CFO Survey, based on a sample of over 130 Dutch CFOs from various sectors.

Get the

conversation

started